Our Focus

CONTACT

INVESTMENT PRINCIPLE

Technology-oriented

Ventures with core technical entrance barrier

Cutting-edge technologies that can compete in the global market

Aim for Global /

Go abroad

Business models that can grow beyond the domestic market and compete globally

Ventures that can take advantage of the domestic experiences to facilitate their global expansion

Stand-alone / Independent

Venture that can stand alone, independent of conglomerate value-chain

Businesses that can display organic growth

Scalability

Place more weight on long-term scalability, not on short-term business metrics

Invest aggressively in businesses showing exponential growth

INVESTMENT AREAS

By industry

InterVest displays excellent performance by identifying and investing in promising ventures in both ICT and biotech/healthcare industries.

01

ICT

02

BIO

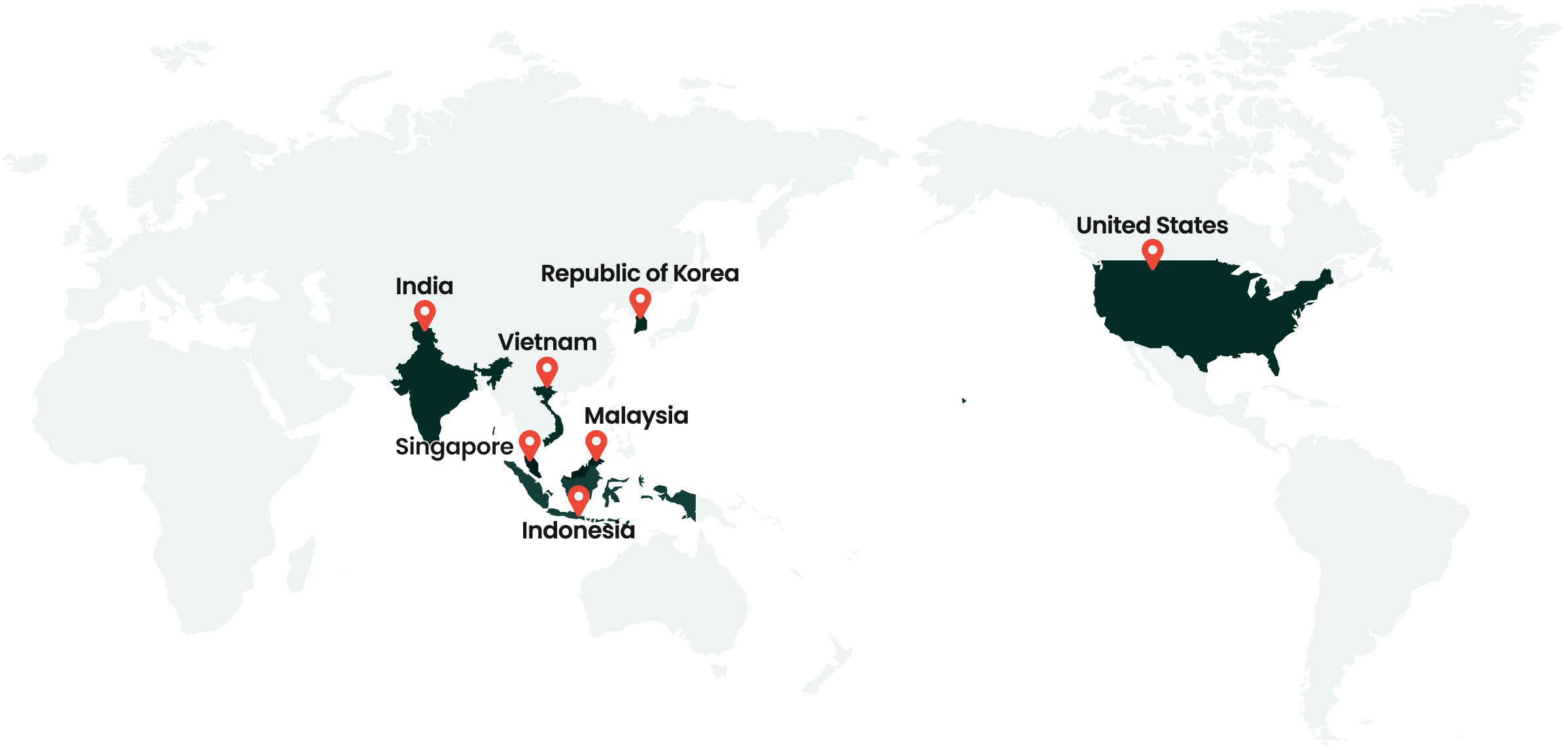

By region

InterVest invests in startups in Republic of Korea, Southeast Asia (Singapore, Vietnam, Indonesia, Malaysia, India, etc.), and the United States.